Is an Early-Out company right for you? 5 reasons your billing company struggles with patient collections!

Does your billing company struggle with collecting patient balances? They just may be. This is not their core competency. Billing companies are experts at collecting money from insurance companies, but are less successful at collecting money from patients. There are a number of factors at play here.

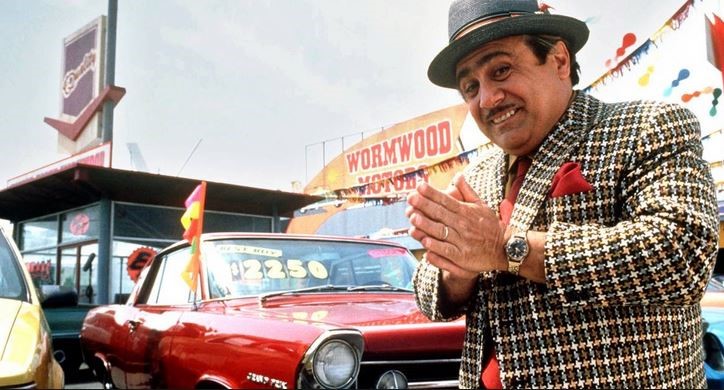

1. With insurance companies paying less and less each year, and patients responsible for more and more out of their own pocket, you cannot leave your patient balances with your billing company to age. Typically, they are sent to the collection agency after 150 days, during which time the patient may only have received a few statements. Most billing companies state they will collect on all of the patient balances over a certain dollar amount. However, if you look under the hood, you may see a minimal service level performed on your patient balances, and it might not be what was promised during the sales process.

2. With insurance carriers paying less, it is vital for your billing company to be properly skilled in the art of recovering money from your patients in a professional manner. Unfortunately, at the standard 3%-10% billing rate, billing companies are not motivated to increase costs to perform the services required to satisfy the growing gap in the marketplace.

3. There is little or no profit left if a billing company needs to rely upon labor at $12-$20 per hour to pursue patient balances.

4. Sending two or three patient statements and making a couple of automated calls is not a comprehensive strategy. It is an impersonal and ineffective way to work with patients, and is not customer service oriented – which may reflect poorly upon your business. This process does not prevent accounts from being moved unnecessarily to collections, where agencies charge a 25-40% contingency fee.

5. “Clean claims” are how billing companies make money. When a medical claim has been successfully submitted and processed by the insurance carrier and a payment is made, there is limited labor involvement, which ensures a healthy profit. There is absolutely nothing wrong with that model. However, pursuing patient balances is the necessary evil that cuts into the billing company’s profit margins. Why would the billing service perform more than the minimum acceptable service level if their profit margin is going to shrink when they do?

A knowledgeable and comprehensive Early Out Solution resolves all of the above challenges for your self-pay inventory.

When choosing an Early Out company, make sure the philosophy of the company is in alignment with your strategies and patient pay policies. An effective Early Out company has the flexibility to work with your patients to collect full balances, set up payment arrangements, and offer prompt pay discounts to accelerate your cash flow.

A comprehensive Early Out strategy will allow the Early Out company to function as remote users on your Practice Management Software (PMS) allowing these users to note accounts, obtain, update and submit new insurance information – even after care has been provided and the patient has left the facility/office. Early Out representatives are extensions of your billing office, offering a deep knowledge base of medical billing along with extensive training in the specific techniques of working with patients. This ensures maximum dollars received early in the patient revenue cycle, while striving at every level to maintain your patients’ satisfaction.

If you aren’t employing an Early-Out strategy, you may be losing money every day.